Delving into Concur Expense System Demo Guide: Compliance, Audit Trails & Reporting Features for US Firms, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Exploring the significance of Concur Expense System for US firms and how a demo guide can aid in better understanding its features is crucial in today's business landscape. This guide will shed light on compliance, audit trails, and reporting aspects, providing a comprehensive view for firms looking to streamline their expense management processes.

Overview of Concur Expense System Demo Guide

The Concur Expense System is a valuable tool for US firms to streamline their expense management processes, ensure compliance with regulations, maintain detailed audit trails, and generate comprehensive reports.

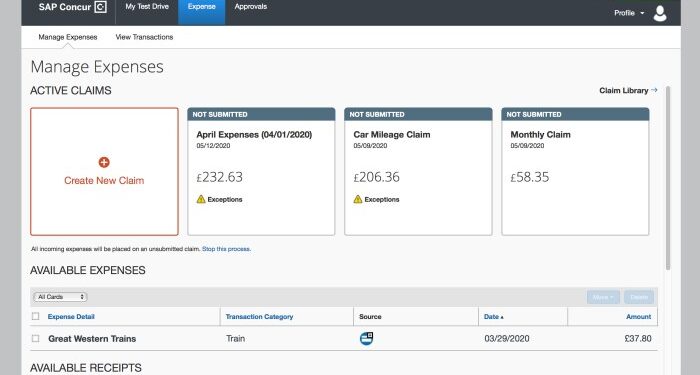

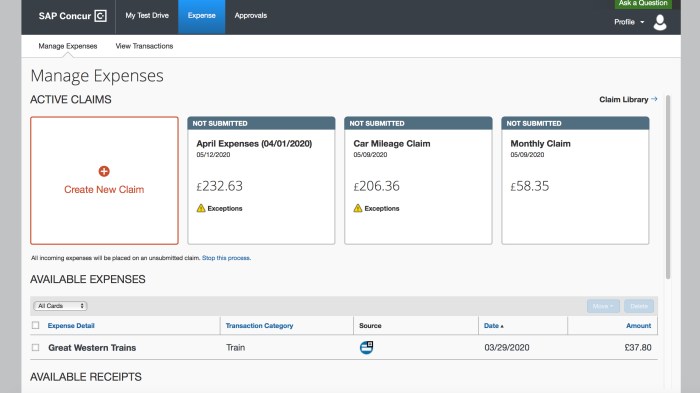

A demo guide serves as a helpful resource for users to familiarize themselves with the features and functionalities of the Concur Expense System. It provides a step-by-step walkthrough of the system, highlighting key aspects that are essential for users to understand and utilize effectively.

Key Sections for Compliance, Audit Trails, and Reporting

- Compliance Features: The demo guide should cover how the Concur Expense System helps US firms adhere to relevant regulations and policies, such as tracking spending limits, enforcing approval workflows, and ensuring accurate expense categorization.

- Audit Trails Functionality: Detailed information on how the system creates and maintains audit trails for all expense-related activities, including who submitted an expense, when it was approved, and any modifications made to the expense entry.

- Reporting Capabilities: Explanation of the reporting tools available in the Concur Expense System, such as pre-built report templates, customizable dashboards, and real-time insights into expense data for better decision-making.

Compliance Features in the Concur Expense System

When it comes to compliance, the Concur Expense System offers a range of features to ensure that users adhere to policies and regulations set by their organizations and governing bodies.

Automated Compliance Checks

- One of the key features of the Concur Expense System is its ability to automatically flag potential policy violations or non-compliant expenses. This helps users identify and rectify issues before submitting their expense reports.

- The system can be configured to enforce specific rules and guidelines, such as spending limits, allowable expenses, and approval workflows, reducing the risk of non-compliance.

Real-time Policy Notifications

- Users receive real-time notifications within the system when they are about to submit an expense that may not comply with company policies. This proactive approach helps prevent errors and non-compliance from occurring.

- By providing immediate feedback, employees can make necessary adjustments to their expense reports and ensure they are in line with regulations.

Audit Trails and Reporting Capabilities

- The Concur Expense System maintains detailed audit trails of all expense-related activities, including approvals, modifications, and rejections. This level of transparency ensures accountability and helps organizations demonstrate compliance during audits.

- Robust reporting capabilities allow users to generate compliance reports, track spending trends, and identify areas of improvement. This data-driven approach helps US firms make informed decisions to enhance compliance efforts.

Audit Trails Functionality in the Concur Expense System

Audit trails play a crucial role in tracking expense activities within organizations, providing a detailed record of all transactions and changes made. This feature is essential for ensuring compliance, transparency, and accountability in expense management processes

Generation and Maintenance of Audit Trails in Concur Expense System

The Concur Expense System automatically generates audit trails for every action taken by users within the platform. This includes logging details such as who made the change, what was changed, and when the change occurred. These audit trails are securely stored and maintained within the system for future reference and review.

- Audit trails in the Concur Expense System capture all expense-related activities, including submission, approval, and reimbursement processes.

- Users can easily access and review audit trails to track the status of their expense reports and identify any discrepancies or errors.

- Administrators can utilize audit trails to monitor compliance with company policies, regulations, and audit requirements.

- By maintaining detailed audit trails, the Concur Expense System enhances data accuracy, reduces the risk of fraud, and improves overall financial controls within US firms.

Reporting Features of the Concur Expense System

Reporting is a crucial aspect of any expense management system as it provides valuable insights and data for decision-making processes and financial analysis. In the case of the Concur Expense System, the reporting features play a significant role in helping US firms streamline their expense management procedures.

Types of Reports in the Concur Expense System

The Concur Expense System offers a variety of reports that users can generate to analyze their expenses effectively. Some of the key types of reports include:

- Expense Summary Reports: Provide a high-level overview of all expenses incurred within a specified period.

- Compliance Reports: Highlight any policy violations or non-compliant expenses to ensure adherence to company guidelines.

- Audit Trail Reports: Track the history of expense submissions and approvals for transparency and accountability.

- Custom Reports: Allow users to create personalized reports tailored to their specific needs and requirements.

Significance of Reporting Features

The reporting features in the Concur Expense System are instrumental in aiding decision-making processes and financial analysis for US firms. By providing detailed insights into expense patterns, trends, and compliance issues, these reports empower organizations to make informed choices, identify cost-saving opportunities, and optimize their financial strategies.

Conclusive Thoughts

In conclusion, the Concur Expense System Demo Guide offers a deep dive into compliance, audit trails, and reporting features tailored for US firms, aiming to enhance efficiency and transparency in expense management. By implementing these tools effectively, firms can navigate complex regulatory environments and make informed financial decisions with ease.

Answers to Common Questions

How can the Concur Expense System Demo Guide help US firms with compliance issues?

The demo guide provides a detailed overview of compliance features within the system, offering insights on policy adherence and regulatory guidelines.

What are the benefits of audit trails in the Concur Expense System for US firms?

Audit trails play a crucial role in tracking expense activities, enhancing transparency, and ensuring accountability within firms, aiding in regulatory compliance.

How do reporting features in the Concur Expense System assist in financial analysis for US firms?

The reporting capabilities allow users to generate various reports, facilitating data analysis and supporting decision-making processes related to financial management.